The Disciplined Entrepreneurship Toolbox

Stay ahead by using the 24 steps together with your team, mentors, and investors.

Sign up for our newsletter

As you have seen on this website, I have been releasing draft chapters for comment from the upcoming Financial Literacy and Fundraising for Entrepreneurs book I am working on. Based on feedback and just looking at the length and complexity of the next chapter, I am now planning to release more bite-sized parts of this next chapter (Chapter 3 – Financial Modeling). In this way, I feel it will be more easily and widely processed and feedback can be more focused. In this vein, here is the first part of Chapter 3 for your review and comment. As always, please don’t feel you have to sugarcoat your comments – “critical feedback is the breakfast of champions” is our motto.

By the way, related to this work, there is now a free online edX course, Fundamentals of Entrepreneurial Finance: What Every Entrepreneur Should Know, taught by myself with my MIT faculty colleagues Antoinette Schoar and Matthew Rhodes-Kropf. I welcome your comments on this too!

What is the purpose of a financial model?

In this chapter, we will teach you how to develop a model to generate projections of your business that provides insights, meaningful projections, a potential path to greatness, and a planning tool. I have heard intelligent people say “meaningful five-year financial projections?!?! – come on! They are surely going to be wrong. How can they be meaningful?”

It is correct that they will be wrong but that does not mean the process of building the model as well as the model itself are not useful and extremely valuable. They will be valuable to you, your team, and other stakeholders. To start with, it will force you to understand what key assumptions you must make to derive the revenue, costs, profitability, growth rate, and other factors that will determine your cash flow – a cash flow that needs to be positive for you to continue to exist. A well-designed model is explicit about what assumptions you are making to build your projections.

The skeptic is correct that all of the model projections will not be 100% correct but they will be correct if all of your assumptions become precisely true, which never happens. That being said, this work in trying to quantify the future will give you great insights into what factors are most critical to your financial sustainability and success – and which ones are less important. You will also have a model and you can adjust to see what the new projections look like as you get more information to more accurately forecast key assumptions. In summary, the thought process and a well-designed model will make it clear what are the key drivers of your business to make it economically viable.

Also extremely important, the model should also show you if a path to greatness is possible, and if it is not, then you shouldn’t do the new venture unless you are willing to give up this hope. There should be some set of assumptions that make your business not just financially viable but attractive and highly impactful. Financial projections help to show if the venture will be able to have the level of impact that motivated you to create the company in the first place. The time, effort, and resources required to build this new venture should be worthy of the opportunity cost it will take to build it. This question is not asked enough by entrepreneurs, educators, and mentors. It is not just enough to survive. You want to maximize your impact.

Making clear what your assumptions are and being able to adjust them to see the impact is central to building a helpful model. It must be simple enough to understand and modify but also capture enough of the complexities of your business.

The Sequencing of Building a Model

Start with modeling the top-line (revenue) and then do expenses.

We will start with revenue first because, without revenue growth, nothing else matters. If you can’t produce sales growth and scale, you can’t solve the problem on the expense side. All revenue curves basically look the same – up and to the right. No shame in that. You don’t want them looking any other way. If they are flat, that is no good. If they are headed downward, run!

Once we have built the revenue model and iterated on it such that we are comfortable with the model’s logic, its assumptions, and ultimately its overall numbers, then we will focus on the costs and build up that part of the business model.

In this chapter, we will build the model in three steps. First, we will build the revenue model to understand revenue growth. Secondly, we will add the costs into the model. Lastly, we will build a summary of the model to make it easy to understand the key points. The last step is very important. You must be able to crisply communicate your financial model, current projections, key assumptions, leverage points to watch for, and the path to greatness.

Building a Revenue Model

Start with your Beachhead Market (BHM)

The first part of building your revenue model should focus exclusively on your beachhead market (BHM). This will make the task clearly scoped and much more achievable. It allows for specificity that you will lose as you move on to other markets that you have less information about. That specificity should give you more confidence you are building your first model correctly.

Later we will add a layer on top of this BHM revenue projections follow on markets but you should begin with a focus on the BHM. It makes the job a lot easier to get started.

When Does Revenue Start to Come Into Your Company?

The first question will be, when do you start to get customers? For some, they can get paid by the economic buyer for the MVBP they produce right away. This can be a good thing because you want to test the customer’s willingness to pay. You can always change (hopefully increase) the price later as you prove your value proposition. As time goes on and you are successful in the market, it also decreases your risk as a vendor which will allow you to raise your prices or more likely, decrease the amount of discount you give out to get a sale. Decreasing your discounts has exactly the same effect as increasing your prices and is generally a better way to achieve the same goal. Your model should be built to allow for increases in pricing (or decreases in discounting but going forward that will be implied) by month, quarter, or year.

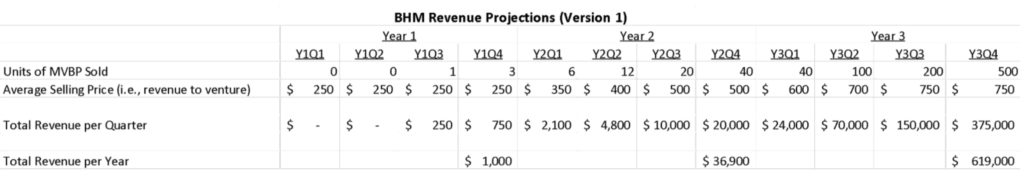

Here is a very simple example to show how to get started:

Notice this model is just focused on the BHM which makes the problem much more reasonable to address. Secondly, you don’t have to generate revenue immediately. It will take you a while to develop your product and get your first customers. Once you have that first customer, you will likely have to or want to give them a discount as you work out the kinks in your product with them.

The number of customers will start small as you refine your product and build your value proposition and company capabilities as well as market presence to be a respected vendor. As time goes on, you are able to dramatically increase the volume of customers that you acquire while also increasing the price.

This is due to the increased validation you have received in the marketplace from your initial successful installations (they had better be successful!).

So, in this simple model, revenue starts in the third quarter of the first year. It is not much but it is the starting point. When does the revenue start for your new venture? If you are developing a medical device that requires a lot of technological development, product development, and regulatory testing and approval, this could take years, which is painful but it is what it is. You might have a mobile app that you can put together an MVBP in a matter of a month so you might be able to get your first paying customer within the first month or quarter. As you can see, it will vary widely based on your situation and industry.

How much should I charge at the beginning?

As you can see from the model above, in the beginning, the price is very low ($250) as compared to what it is projected to be three years later ($750). Why is that? This is because at the beginning, you don’t have pricing power and you want to have customers who are more forgiving as you iterate to improve your product. You have not yet proven your value proposition in the market place and you are seen as a risky vendor. Rarely does a person or organization want to be that first customer (it is very risky to be first) so you have to give them some incentive. You would generally do this by giving them a discount. It is almost always easier to have a high list price and give people a discount and then later decrease the discount you are giving people than to raise the price. You can raise the price but you generally want to do this with a release of a new product with a lot more functionality (e.g., iPhone 10 to iPhone 11s with a new camera). Increasing the list price on the same product is a tough sell often to customers as they are conditioned to the previous price. Hence, decreasing discounts is a less conspicuous way to increase prices if you can do it properly.

There can be a case for not charging customers, especially end-users who are not the economic buyers, at the beginning. I must admit, I am not a big fan of this except in extreme cases. You have not proven one of the key elements you need to in an MVBP if you do not charge, that is the economic buyer’s willingness to commit to paying something. If there is no skin in the game and the product is free, have you really proven one of the most important hypotheses of entrepreneurship, i.e., that you can extract rent for the value you have created? No. That is why I am generally skeptical of this approach.

That being said, if your business is a platform or one that depends on monetizing the data collected from lots of end-users, it is virtually impossible to get the economic buyer to pay until you have acquired users. This is really the exception to the rule but it should not be used as a cop-out for others to avoid gaining a commitment from the economic buyer to pay something (it does not have to be full value to start) for the value you are creating.

Behavioral economists have shown it is very hard to get people to pay for things that they have gotten for free historically. It is hard enough to get them to increase the amount they pay but it is much worse to get them to pay anything when they have paid nothing and the mental model they have is that the product or service is free.

So my advice is to charge the economic buyer(s) something as soon as possible and then increase it over time as you prove your value proposition and your company. At a minimum, call it a “free trial period” so you can go back and extract rent at the end of the trial period.

The author

Bill Aulet

A longtime successful entrepreneur, Bill is the Managing Director of the Martin Trust Center for MIT Entrepreneurship and Professor of the Practice at the MIT Sloan School of Management. He is changing the way entrepreneurship is understood, taught, and practiced around the world.

The books

This methodology with 24 steps and 15 tactics was created at MIT to help you translate your technology or idea into innovative new products. The books were designed for first-time and repeat entrepreneurs so that they can build great ventures.

How relevant was this article to you?

Click on a star to rate it!

Average rating 4.6 / 5. Vote count: 22

No votes so far! Be the first to rate this post.

We are sorry that this article was not useful for you!

Let us improve this post!

Tell us how we can improve this post?

Hey Bill, thanks so much for continuing to share snippets of your new book this way – it’s extremely useful!

My question would be how building an initial financial model connects to the previous steps that a founder should first complete.

From my perspective that would be first collecting customer insights to help validate the market (while also collecting key data on the market, barriers, competition, customer etc) and then using these insights to generate a business model canvas that now has each assumption backed up by customer data.

I assume that this BMC would then be the basis for understanding how you’ll make revenue (incl. potential pricing) and what your costs may be in order to feed into the BHM revenue projections you discussed here, right?

Thanks again for sharing this!

Alan

Hi Bill – very clear and easy to understand 🙂 Maybe might be useful to explain the acronym MVBP . Best, Martina

Hi Bill, thanks a ton for sharing this!

The chapter made me think of the Eisenhower quote: “Plans are useless, but planning is everything”.

I agree that what’s important is not only the first budget version (to sanity check) but also the discussion on assumptions that lead to that budget. From there, it’s key to have a flexible system where you can easily follow up on your assumptions and readjust as you go. Building financial models is almost like building software (databases, computational pipelines, logic, UI), and you want to work agile, not with a waterfall approach. In other words, revisit your model based on your latest understanding as you go and not cling to the 5-year forecast.

It might be relevant to add a perspective on the typical revenue forecast models that startups can use based on different business models and stages, e.g., P*Q, P*Q with segments/price tiers, account-based, cohort-based, growth-rate-based, project-based, etc.