Entrepreneurship Is a Craft and Here’s Why That’s Important

Republished from MIT Sloan Management Review.

To inspire today’s generation of company builders, entrepreneurship education needs a common language and apprenticeship opportunities.

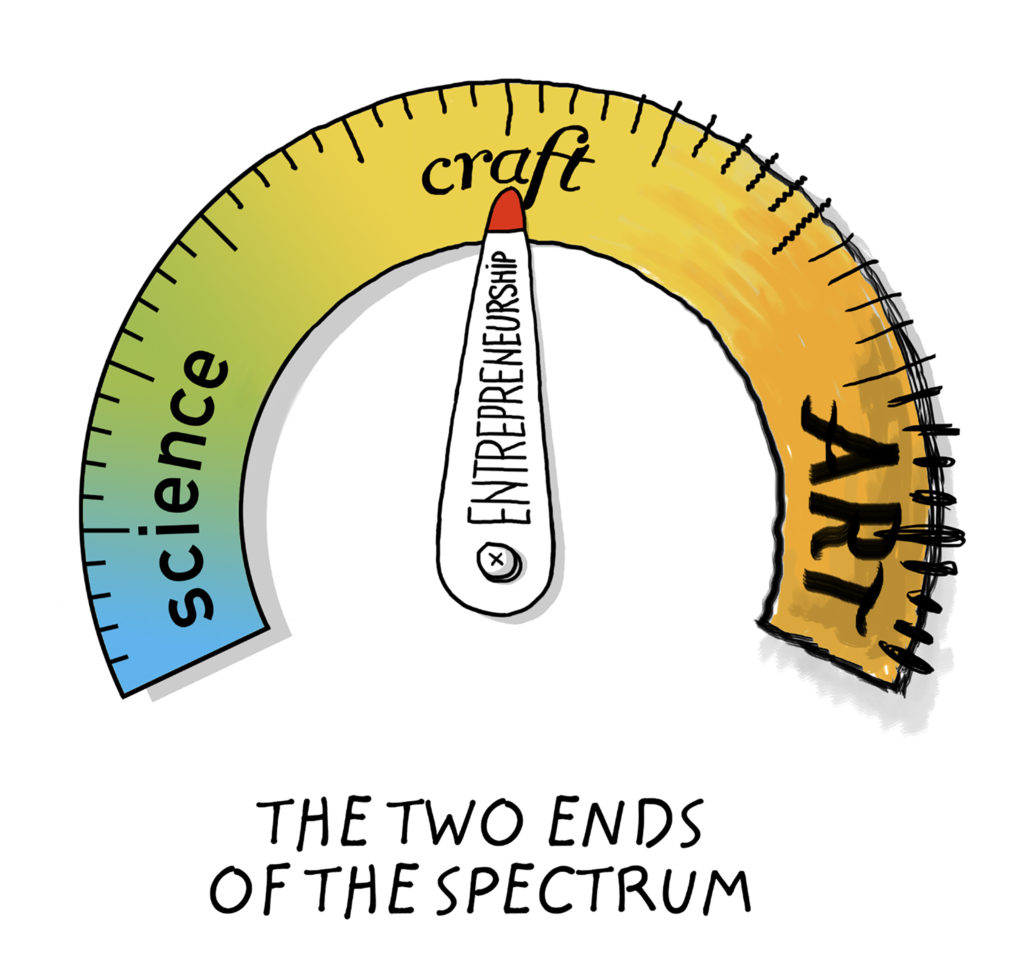

In my 20-plus years as an entrepreneur and seven years as an entrepreneurship educator, I have explored whether starting successful companies should be thought of as a science or an art. If entrepreneurship is a science, then I could easily teach my students that if they perform actions X and Y, they will get a result of Z. If it is an art, then it can be described no more precisely than as an ambiguous creative process that only a chosen few can pursue as a profitable career.

While I find many elements of entrepreneurship that draw from empirical processes, I also find many others that require creativity. In looking for a mental model that encompasses both requirements in a cohesive model for how to most successfully approach the startup process, I started thinking about potters. These skilled individuals imbue artistry into each pot they throw, but if they don’t have knowledge of the fundamentals of how to mold clay into finished objects, they won’t succeed in their goal. Pottery is neither science nor art. Instead, it’s a craft — a process that draws from both.

There are a few key characteristics of pottery that firmly plants it into the realm of craft, rather than being either an art or science:

It’s accessible. Almost anyone can make a pot from clay. It is not something available only to an elite few who are gifted with extraordinary talent.

It’s learnable. Pottery consists of a number of fundamental skills that aren’t obvious without being taught the particulars of the discipline, but these skills can be taught and learned. Luck alone does not make a potter.

It values unique products. When pottery is done well, it is beautiful and unique. The goal of many pottery craftspeople is not to mass-produce the same item that they or others have created before, but to make something new and valued.

It’s built on fundamental concepts. When a potter is learning how to throw clay on a pottery wheel, there are basic principles such as how to use your fingers and thumbs to mold differently sized grooves and how to perfectly calibrate your foot pedals. While knowing these won’t guarantee success, they can dramatically improve a potter’s odds of understanding more complex concepts later on.

It’s best learned through apprenticeship. For many craftspeople, a crucial part of the education process is apprenticeship. Understanding the full body of knowledge about the craft involves not only using the pottery wheel but other specific skills such as kneading, wedging, and using a kiln. These can be explained via lecture without hands-on practice, but are best learned when combined with apprenticeship-type training.

The author

Bill Aulet

A longtime successful entrepreneur, Bill is the Managing Director of the Martin Trust Center for MIT Entrepreneurship and Professor of the Practice at the MIT Sloan School of Management. He is changing the way entrepreneurship is understood, taught, and practiced around the world.

The Disciplined Entrepreneurship Toolbox

Stay ahead by using the 24 steps together with your team, mentors, and investors.

The books

This methodology with 24 steps and 15 tactics was created at MIT to help you translate your technology or idea into innovative new products. The books were designed for first-time and repeat entrepreneurs so that they can build great ventures.

Effective Manager? Yes. Leader? TBD

Republished from The Boston Globe.

In the fall of 1977, the aspiring Harvard varsity basketball players used to play pickup games every afternoon. All of us were vying for the limited spots on the team. The competition was fierce. I remember one not particularly athletic guy, less of a thoroughbred and more of workhorse, a Clydesdale. I did not see him making the team, but Charlie Baker surprised us. He not only made the team, but turned out to be a terrific teammate.

Governor Baker’s challenges now are much bigger and more significant, but the same attributes he showed back then — a hard worker who knows his limits, a guy who doesn’t take himself too seriously, but is still comfortable being an enforcer when needed — have never left him.

The big question for Massachusetts is whether he can pull off something rarely seen in business and even less often in politics — to be both a great manager and a great leader. To put this in context, managers optimize resources and produce consistent results, and leaders inspire people to effect positive change that is much more than incremental.

On the management side, Baker has taken the reins like a good MBA would, tackling challenges like the MBTA and the opioid crisis with working groups that create logical plans of action for achieving concrete goals. The T doesn’t run well in the winter? Charlie’s Winter Resiliency Plan announced in June will fix certain infrastructure, on a certain timetable, with certain budget funds. A thousand people died from opioid overdoses last year? Charlie’s opioid addiction bill will aim to lower that number by targeting how drugs are prescribed. So as a manager, his reputation as “Mr. Fixit” has proven valid.

The more complicated analysis comes in leadership. The first necessary condition of leadership is to have a clear identity that emanates from core principles. On this front, not only has he articulated core principles, but he has walked the talk. Fiscal conservative, social liberal. Handle problems with a mindset that is moderate, fact-based, tough, and not impaired with political and emotional baggage. He has largely stuck to this approach, with one regrettable exception: his initial opposition to resettling Syrian refugees in Massachusetts, a knee-jerk reaction to the Paris terrorist attacks.

His values tend to be management-centric. The distributed leadership model of the MIT Sloan School of Management is a useful lens to continue the assessment. This framework outlines how effective leaders design organizations to complement their strengths and weaknesses.

This model defines leadership as consisting of both enabling and creative capabilities. The enabling capabilities include making sense of complicated circumstances and building relationships to motivate and sustain change. On the other hand, creative capabilities — developing vision and inventing ways to achieve it — provide focus and energy. The latter are essential for organizations to be truly transformative.

Charlie has shown a great willingness to develop enabling capability in his administration by identifying, recruiting, and retaining top talent regardless of political affiliation. Secretary of Transportation Stephanie Pollack has been a progressive policy advocate for decades; Secretary of Health and Human Services Marylou Sudders is a proud social justice independent; and Chief Legal Counsel Lon Povich advised former governor Deval Patrick on judicial nominees.

The creative capabilities assessment is yet unknown. Vision is what a leader like Martin Luther King Jr., John F. Kennedy, or Ronald Reagan so effectively communicated to us. A vision is an exciting world of what’s possible. It inspires in a much more powerful way than simple competency ever can.

A vision is then-Governor Frank Sargent canceling the destructive highway bypass projects in the 1970s and doubling down on mass transit, including the Red Line’s expansion to Alewife. In his first year, Charlie has yet to offer that compelling vision.

The successful integration of an excellent manager and excellent leader is rarely achieved. It often seems like the two skill sets can’t overlap. That’s not true; it’s just extremely hard to do. The next act for Charlie is to provide that inspiring vision while continuing management excellence. It seems like a real stretch, but based on personal history, I would not bet against the Clydesdale, Charlie Baker.

The author

Bill Aulet

A longtime successful entrepreneur, Bill is the Managing Director of the Martin Trust Center for MIT Entrepreneurship and Professor of the Practice at the MIT Sloan School of Management. He is changing the way entrepreneurship is understood, taught, and practiced around the world.

The Disciplined Entrepreneurship Toolbox

Stay ahead by using the 24 steps together with your team, mentors, and investors.

The books

This methodology with 24 steps and 15 tactics was created at MIT to help you translate your technology or idea into innovative new products. The books were designed for first-time and repeat entrepreneurs so that they can build great ventures.

The Most Overrated Thing In Entrepreneurship

In 2013, I wrote a light piece for Forbes about the “Six Whopping Lies Told About Entrepreneurs” but in hindsight I left out the biggest myth of all about entrepreneurship itself. The single most overrated, and yet common, belief about entrepreneurship is that the idea is paramount.

Yes, an idea is necessary, but it is so much less important than the discipline and process with which the idea is pursued. And, interestingly, all of these are even less important than the quality of the founding team.

The belief that the idea is important becomes invalidated when you work with successful entrepreneurs and begin to see a common pattern emerge: how an original idea morphs and evolves over time as the team does primary market research and starts to focus on customer needs, rather than their initial eureka moment. This observation is borne out in recent research by Professor Matt Marx of MIT, summarized in “Shooting for Startup Success? Take a Detour,” showing that for successful entrepreneurs, the idea they originally started out with is rarely the same as what they ended up succeeding with.

The idea of a better search engine wasn’t novel before Google got started; its value creation was all in the high-quality execution. Similarly, the concept of an electric car was not new when Elon Musk started Tesla, yet it has experienced unprecedented success while others before and since have failed. Likewise for the smartphone and Apple.

I know in my companies, we ended up at much different places than where we thought we would. With one, SensAble Technologies, we thought we were going to be a medical simulation company and we ended up an industrial design company. Another highly visible MIT company, E*Ink, started out focused on digital ink screens for retail outlets, then shifted to low-power cell phone screens, then finally found success with e-readers like Kindle – and now the broad-based market of electronic paper displays. Time and time again, success is not based on the original idea but rather on disciplined execution and the quality of the founding team.

In fact, it is dangerous to become too attached to the original idea and not to the needs and wants of the customer. Too often, the result is that entrepreneurs feel they need to be in “stealth mode” so they can build out their idea before someone can “steal” it.

If you have fundamental intellectual property, this strategy is recommended until you have a chance to patent the key elements of your breakthrough. However, it is then essential to get out and talk with customers, lest you end up like Dean Kamen, who holed up in New Hampshire with his stealth project code-named “Ginger, which also became known as “It.” Enormous hype was built up around “It.” The product, the Segway, finally came out, and as the lackluster consumer adoption demonstrated, “It” would have benefited from a lot more open vetting of the idea and a lot less stealth.

As former student Andy Campanella tells students in our introductory entrepreneurship class at MIT, “If you meet someone in a coffee shop and they can steal your idea and beat you with another company based on your idea from a 15-minute conversation, then you deserve to lose and you did not have very much to begin with.” Or as Dharmesh Shah says, “stealthy is unhealthy.”

In my book, Disciplined Entrepreneurship, I give a framework for a methodical approach to startups that can help guide entrepreneurs through the process of iterating on their ideas, and I look forward to working with students at Strathclyde in the near future on this topic. But to really dive into how to build a strong team and the importance of a unifying culture, I recommend Harvard Business School Professor Noam Wasserman’s seminal book The Founder’s Dilemmas and I would also steer you to a popular article I wrote in TechCrunch titled “Culture Eats Strategy for Breakfast.”

So the next time you listen to an entrepreneur get overly excited about their breakthrough idea, wink at them and tell them that while they need an idea to get started, their focus should be on people and process because in the end, they are what will determine success.

Read the full post on The Strathclyde Business School Blog.

The author

Bill Aulet

A longtime successful entrepreneur, Bill is the Managing Director of the Martin Trust Center for MIT Entrepreneurship and Professor of the Practice at the MIT Sloan School of Management. He is changing the way entrepreneurship is understood, taught, and practiced around the world.

The Disciplined Entrepreneurship Toolbox

Stay ahead by using the 24 steps together with your team, mentors, and investors.

The books

This methodology with 24 steps and 15 tactics was created at MIT to help you translate your technology or idea into innovative new products. The books were designed for first-time and repeat entrepreneurs so that they can build great ventures.

Culture Eats Strategy For Breakfast

Republished from Techcrunch.

I used to think corporate culture didn’t matter. Discussion of vision, mission, and values was for people who couldn’t build a product or sell it! We had work to do and this MBA BS was getting in the way! And then my first company failed.

Cambridge Decision Dynamics did not fail because we didn’t have a great technology or a great product or customers. It failed as a sustainable, scalable organization because we had no meaningful purpose to create team unity to fight through the tough times. Now the company sits comfortably in a perpetual state of what I like to call “deep stealth mode.”

Compare this to the rapidly growing company Eventbrite that I visited recently with some of my students. Eventbrite enables event planners to manage ticket sales and RSVPs online, and its users have sold over $2 billion in tickets.

There was palpable energy and excitement in the air when we stepped in the door. Dozens of neatly parked bicycles spanned a row next to the smiling receptionist. The employee who gave us a tour proudly showed off their conference rooms named after big events that they had helped their customers pull off, including “Promunism,” which was a Communist-themed high school prom. That room had a conspicuous red rotary phone for the emergencies that might come up in planning such a large event, a clear and visible sign linking the company to its customers in a positive manner.

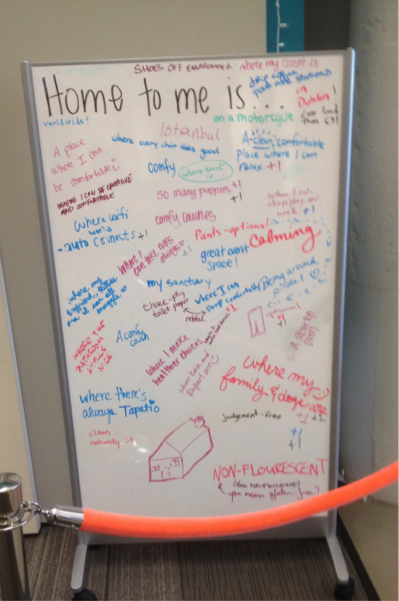

A minute later, we walked by a whiteboard with the prompt “Home to me is…” that was covered with enthusiastic employee suggestions.

Being from New York, I am inherently skeptical about worlds of happiness and cohesion. But it all made sense when our host, VP of marketing, former MIT student, and single-digit-number employee Tamara Mendelsohn, came striding in the room, beaming with pride and energy, to discuss how Eventbrite went from just a few employees to hundreds and became a model of success for others in Northern California.

There was a lot of technical advice on primary market research and marketing techniques to drive market traction, but by far the most interesting part was about how the founders and the leaders of the company had consciously “engineered the company’s culture.” At first, she explained, the primary focus was testing for humility during the hiring process, and they had a checklist to enforce their “no assholes” rule. But they quickly realized they needed to do more.

As the company grew, they wanted to keep the same GSD (Get Stuff Done) attitude across the company and not let their company turn into “just another company.” This was tricky, but because the founders and employees were deeply committed to this attitude, they developed the following solution: “You can’t complain here,” Tamara explained. “If you see something wrong, you must fix it. We say it is a great opportunity to come up with a solution, and this is where many of our best programs have come from. Anything can be changed. We aren’t victim to anyone. We own the culture.”

It is no accident that such a strong culture has produced such a successful company. Event planners have enough to worry about without their ticket-sales software having problems – it needs to just work. When we have used the tool for our center’s events, we have found both a good feature set but also a super-responsive technical support team that has us covered when we screw up or don’t understand certain features. When Tamara explained Eventbrite’s culture to us, it made sense to me why their support team was so on point.

As we talk about in our classes (and credit to Peter Drucker who had the original quote which we have modified), “culture eats strategy for breakfast, technology for lunch, and products for dinner, and soon thereafter everything else too.” Why? Because company culture, a concept pioneered by Edgar Schein, is the operationalizing of an organization’s values. Culture guides employee decisions about both technical business decisions and how they interact with others. Good culture creates an internal coherence in actions taken by a very diverse group of employees.

Some may believe that culture cannot be “engineered,” and that it just happens. It is true that culture happens whether you want it to or not. It is the DNA of the company and is in large part created by the founders – not by their words so much as their actions. So the very decision to not try to create a corporate culture, or worse, to not have company values, is, in fact, your choice of what culture will prevail – and not for the better.

Should this have been a surprise to me? No, because for over a decade in the 1980s and early 1990s, I worked for IBM when it was the most respected, profitable and rapidly growing company in the world. From day one of training (training which lasted often for two years), the company made clear the importance of their trio of core values: respect for the individual, superlative customer service, and the pursuit of excellence in all tasks. It was this fervent adherence to these core values – through the training, the monthly communications, the performance-appraisal system, the role models, and ultimately every decision we made –that made us great.

In my later years there, I had seen a distinction erosion of management’s commitment and adherence to these values. Leaders started to cut corners on these to achieve short-term objectives, as they felt less confident in their position and felt it was more important to deliver short-term results. It was this ambiguity about these values that contributed so mightily to the fall of IBM, which led to the installment of Lou Gerstner as CEO.

As he worked to turn around the business, he came to a deeper understanding of the issue, which he voiced himself at the end of his tenure: “I came to see in my time at IBM that culture isn’t just one aspect of the game – it is the game. In the end, an organization is nothing more than the collective capacity of its people to create value.”

While IBM is a large company, this pattern is true as well for the world of startups I now operate in — especially startups that want to scale. My colleague, Paul English, built a unique culture at Kayak that was the foundation of that company’s success. The founders created a system where their company culture of excellence and productivity was created from the hiring process through to operations. Meetings, where decisions were to be made, were to have no more than three people because then people were wasting their time. This created a culture of action and accountability while trading off consensus.

This culture does not work for all people and all companies but they made no apologies for it at Kayak and pursued it consistently. It was reinforced daily by practices ranging from Paul’s behavior to the size of conference rooms to the incentive system. The result of these efforts was that the company’s revenue per employee was $1.25 million, which was more than double the industry average. In June 2013, Kayak was purchased for $1.8 billion by Priceline.com.

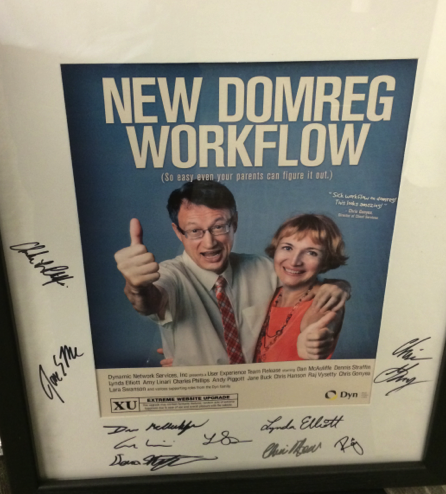

Another example is a company called Dyn, which is based in Manchester, NH. This company performs the crucial but unglamorous work of creating, managing and improving the plumbing of the Internet for users. The company’s founders believed deeply that they needed to have a strong culture. Aligning with what will create value for their customers, they focused on creating an environment that was exceptional at allowing people to be honest about their mistakes, driving them to rectify them, and then celebrate and immortalize the technical efforts that brought the solutions to life.

Again this culture was brought to life by the real estate, the way visitors were handled, the actions of the company leaders and their highly visible movie posters. An example of a movie poster is shown below. In this case, the customer had a broken workflow for registering new domains, so the employees worked on a solution that made it so easy “even your parents can figure it out.” The company then invested in creating the poster below and then having the team sign the poster. It is now permanently and prominently hung in their headquarters. It is no surprise to me that Dyn has grown from 53 employees in 2011 to 300 employees today and is considered a huge success story in an unconventional location.

Every company, especially startups, will experience random events that will help or hurt. It is impossible to fully anticipate these events ahead of time. That’s not the question. The question is how your organization will react to the series of inevitable unknown and random events.

A strong product plan is great, but it also takes strong culture to handle potentially adverse scenarios in a positive way. A positive culture like Eventbrite’s takes what would be an inherently fragile human system and makes it anti-fragile (i.e. it gets stronger with random events), to use the concept that Nassim Nicholas Taleb describes in his books. The unpredictable world of a fast-growing startup, and the daily decisions that must be made in response, tend to make the venture stronger rather than weaker or more confused.

So count me among the completely converted. When I talk to entrepreneurs now, before I get too carried away with the idea, I want to probe them about their vision, mission and values. Ideas are cheap – and tasty too. Culture eats them even before its pre-breakfast morning run.

The author

Bill Aulet

A longtime successful entrepreneur, Bill is the Managing Director of the Martin Trust Center for MIT Entrepreneurship and Professor of the Practice at the MIT Sloan School of Management. He is changing the way entrepreneurship is understood, taught, and practiced around the world.

The Disciplined Entrepreneurship Toolbox

Stay ahead by using the 24 steps together with your team, mentors, and investors.

The books

This methodology with 24 steps and 15 tactics was created at MIT to help you translate your technology or idea into innovative new products. The books were designed for first-time and repeat entrepreneurs so that they can build great ventures.

Avoid Stagnation: Acceleration Trumps Incubation

Republished from Techcrunch.

Interest in startup accelerators and incubators has exploded in the past several years, but how effective have they been? One thing that has become clear is that “incubator” and “accelerator” refer to two very different models for startup workspaces, and the distinctions may have significant effects on startup success.

The key distinctions between incubators and accelerators are time period and structure. An incubator gives startups workspace and community at an affordable rate for an indefinite time period. Accelerators generally have workspace and a cohort that forms a community. They are run over a fixed time period with some significant degree of structure with regard to education and coaching. Accelerators are also capped by a demo day after which startups have to make it on their own, without further subsidy from the accelerator.

While the business incubator concept has been practiced in the U.S. since 1959, it has only been since 2005 that accelerators have become an alternative, and their rapid ascent in popularity over the past decade has been striking.

Y Combinator and TechStars are the two most well-known and successful examples of the accelerator model. But seemingly every day, they are joined by new industry, regional or corporate implementations of this approach. Universities, like MIT, have taken notice in the strong interest from its students in such programs and while there were strong and varying feelings about the efficacy of each model, there was little concrete data to validate the assertions being made.

So it was with great interest that I got to see the difference firsthand through two programs MIT ran for its student entrepreneurs during the summer of 2012, one using an accelerator model and the other an incubator model. Running proper experiments on startup education is hard, but through a series of accidental but fortuitous events, the teams selected for the programs were similar enough that we can draw conclusions about the programs by comparing their levels of success.

Accelerator Vs. Incubator

The accelerator, called the MIT Founders’ Skills Accelerator, or FSA, (now the MIT Global Founders’ Skills Accelerator, or GFSA), was announced in the spring of 2012 and attracted 129 applications for 10 spots. As a result of the extraordinary demand, the applicant teams were of such a high quality that we had a deep pool of qualified candidates beyond the 10 we could accept for the student accelerator program. As a result, we were able to procure space for a student-led incubator, called the Beehive Cooperative. Since the caliber of the FSA and Beehive teams were very similar, it significantly lessened the “selection bias,” which suggests that FSA teams would have stronger outcomes because they were stronger teams to begin with. In all, some 40 teams participated in the Beehive that summer.

Each program had dedicated workspace in its own location, and participants quickly built strong communities that were fostered by the program leadership. The difference came in the educational structure.

The FSA put teams through twice-weekly seminars, countless individual meetings with mentors, and monthly “board meetings” that held teams accountable to the milestones they set at the beginning of the summer. Teams could earn up to $20,000 by meeting the milestones. By contrast, the Beehive offered occasional guest speakers, but otherwise participants had to take the initiative to schedule meetings with our center’s mentors.

The results proved informative for how we design programs to support student entrepreneurs. We expected to see both groups make good progress because they would receive lots of encouragement from the peers in their community, and the dedicated workspace would allow them to focus better. FSA teams would probably do better with the more high-touch support, but with so many strong Beehive teams, we expected some level of improvement across the board.

However, while some Beehive teams did achieve success, the overall rate was much lower than the accelerator teams. The rate of progress was noticeably lower as was the drive to get their team to achieve “escape velocity” – our term for being a strong enough team to move out of the “MIT bubble” and establish itself as a standalone company.

An unexpected side effect of the Beehive was that teams did not want to leave the community they had built. The very social bonds and support that created such positive effects also had the negative effect of creating an environment that was too comfortable. The image of an incubator as a warm comfortable place to hatch eggs comes to mind and starts to haunt us. Fortunately for us, we had two forcing functions – many of the students were on the verge of graduating, and the extra space we had for the program was temporary due to an impending renovation of the building.

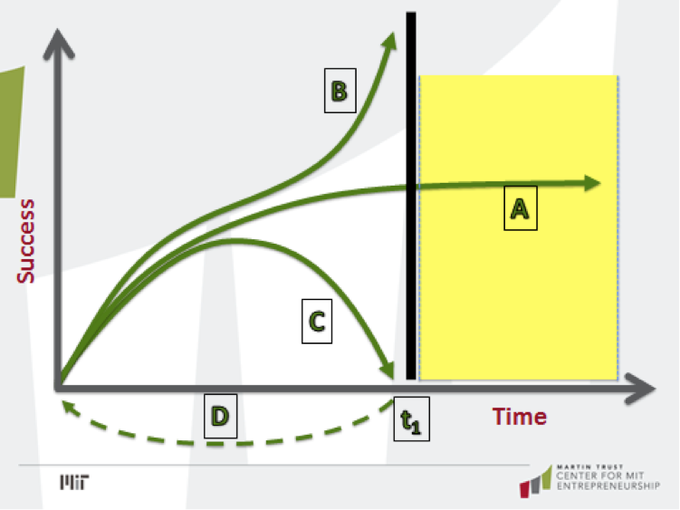

Does that mean that the Beehive experiment was a failure? Absolutely not. But while we would enthusiastically do it again, we would redesign the program. What made the difference between these two programs, and how specifically would we redesign the Beehive program to be more effective? A lot of it boils down to a simple chart:

Teams participating in the Beehive tended to follow line A on the graph, in which they made initial progress but stagnated over time. By contrast, teams participating in the FSA underwent several forcing functions throughout the program. Within the first 30 days, they put their ideas (and teams) to rigorous testing, so that by the end of the month (“t1” on the graph), they either had to show they were on the path to great success (line B), or they had to scrap or significantly revise their idea (line C). The individual components of their business were regularly scrutinized, as well.

Teams participating in the Beehive tended to follow line A on the graph, in which they made initial progress but stagnated over time. By contrast, teams participating in the FSA underwent several forcing functions throughout the program. Within the first 30 days, they put their ideas (and teams) to rigorous testing, so that by the end of the month (“t1” on the graph), they either had to show they were on the path to great success (line B), or they had to scrap or significantly revise their idea (line C). The individual components of their business were regularly scrutinized, as well.

Now, you may say, “Of course line B is the goal, but it’s hard to achieve. Isn’t the moderate success of line A better than the failure of line C?”

The answer is an emphatic NO! Companies following the path of line A are the “barely living.” Their rate of progress has slowed to near-zero – significantly less progress than they could make doing something else, both for the entrepreneur’s benefit and society’s benefit. As the rate of progress slows, the entrepreneur’s rate of learning slows, making them less-prepared for tackling the challenges of future startups. The startup will last only as long as the money does, if the entrepreneur doesn’t lose interest first.

By contrast, companies that follow the path of line C don’t waste time and money doing something that doesn’t work. In failing, they learn a lot about how to improve. They are ultimately on a better path to end up on line B with a successful company. Some may even decide, after enough line C failures, that they do not want to pursue entrepreneurship, giving them the opportunity to establish a career years earlier than the stagnant startup stuck on line A.

Therefore, a well-designed accelerator will force its participants onto either line B or line C by default, preventing or at least dramatically reducing the occurrence of line A. And we found in the FSA that teams that followed line C were able to quickly retool and establish strong businesses along line B.

An example is Loci Controls, which started out as an idea involving network-connected solar panels. A few weeks into the FSA, they saw major shortcomings both with the idea and the composition of their team. They added a team member and began exploring turning landfill gas into energy. They have seen a lot of success, and were just funded by CommonAngels. A second example, from our 2013 GFSA class, started with a very specific medical idea, and realized within two weeks under the pressure of the GFSA that they were not on line B. They regrouped and developed a new venture, ImSlide, around power line de-icing that was much more successful for them.

In these two cases in particular, the defined time period, hands-on mentoring, and uncompromising board-meeting sessions resulted in hard decisions being made sooner rather than later, with no option to choose a “comfortable state.”

Our experience with the Beehive is in line with other data about incubators. Dane Stangler, the vice president of research and policy at the Kauffman Foundation, reports that “Multiple studies have shown that incubators don’t work and, worse, they frequently subsidize companies that would otherwise fail. One report suggested that 90 percent of public and private incubators in the U.S. were ineffective. True, there are a handful of successful incubators, but incubators suffer from a design flaw: they are more often about real estate than entrepreneurship.”

As for accelerators, the data is not in yet, but MIT’s experience is encouraging. One key question to consider is whether the success of teams coming out of accelerators is due to the accelerator’s ability to attract and select great teams (sorting or selection value) or to the actual added value created in the program (added value). MIT professor Yael Hochberg pointed me to a study done by Columbia professor Morten Sorensen that showed in venture capital deals that 60 percent of the value created is based on selection value, and only 40 percent is added after the selection.

Our FSA/Beehive experiment reduced the selection bias as much as possible, and we were still able to see a significant improvement from teams in the acceleration model versus teams in the incubator model. It makes sense to me that when a team is forced out of its comfort zone, it will rise to the occasion far more than a comfortable team; it is why I channel Eleanor Roosevelt and tell teams “to do something every day that scares the daylights out of you” if they want to be great.

We will certainly do a program similar to the Beehive in the future, because the number of MIT student entrepreneurs is vastly more than the FSA’s super-high-touch model can support. But we will make it more of an accelerator than an incubator, incorporating lots of time-defined forcing functions and a more hands-on mentorship approach. This has also influenced how we design the accelerator program going forward. An overview of our continually evolving accelerator program is available online.

We hope this insight can also help future programs elsewhere to be better designed and for entrepreneurs to understand the strengths and weaknesses of each. “Incubator” and “co-working” spaces (which, due to the great economies of scale they provide startups, often resemble incubators in function) can have a positive role in a robust entrepreneurial ecosystem, but their limitations should be known and carefully considered.

Programs can and must be thoughtfully designed to avoid stagnation and instead provide a positive impact on entrepreneurial growth. This experience reminds us that “comfort” is a word that negatively correlates with great innovation and entrepreneurship.

The author

Bill Aulet

A longtime successful entrepreneur, Bill is the Managing Director of the Martin Trust Center for MIT Entrepreneurship and Professor of the Practice at the MIT Sloan School of Management. He is changing the way entrepreneurship is understood, taught, and practiced around the world.

The Disciplined Entrepreneurship Toolbox

Stay ahead by using the 24 steps together with your team, mentors, and investors.

The books

This methodology with 24 steps and 15 tactics was created at MIT to help you translate your technology or idea into innovative new products. The books were designed for first-time and repeat entrepreneurs so that they can build great ventures.

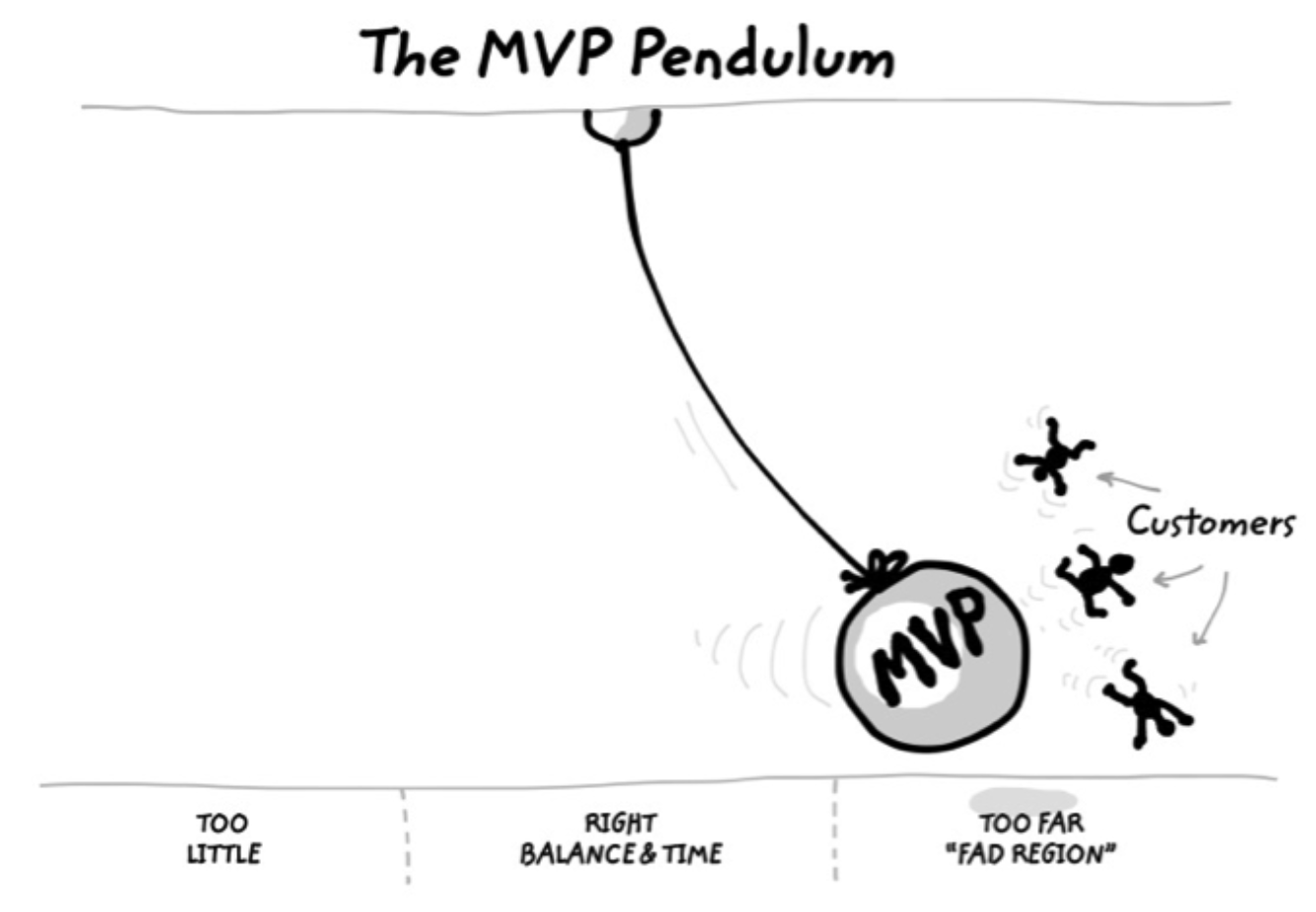

Our Dangerous Obsession With The MVP

Republished from Techcrunch.

Building stuff does not make you a startup. “But don’t we need to build stuff and iterate quickly?” I get asked a lot.

Well, sure. Once upon a time, when companies used the “old-school” waterfall model to develop products, pushing entrepreneurs to think in terms of building a minimum viable product as quickly as possible made sense. It substantially accelerated the development process. By narrowing the product scope to core features, you start the customer feedback loop quicker and you can more rapidly iterate based on that feedback.

But the pendulum has swung too far toward building stuff and away from spending some time getting to know your customer first. And the result is that more startups are building blindly, without focus, as well as falling victim to the “IKEA effect.”

The IKEA effect, coined by Michael Norton, Daniel Mochon, and Dan Ariely, is that when you make something yourself, you value it way more than you should. The trio did tests showing that amateur origami makers valued their creations as equal to those made by experts – even though the expert-created pieces were objectively of a much higher quality. The phrase is named after the well-known Swedish furniture chain where “some assembly required” is an understatement. As a result, as soon as we build something, we all tend to move increasingly from inquiry mode to advocacy mode at the very time where the former is needed and the latter can blind us.

As soon as we build something, we all tend to move increasingly from inquiry mode to advocacy mode at the very time where the former is needed and the latter can blind us.

One of our recent alumni teams, who will remain nameless for reasons you’ll quickly see, is absolutely in love with the technology they have created. They have developed some impressive award-winning technology which has the promise to significantly improve the Human Computer Interface. They have built a demo that is in high demand, and each time someone expresses interest in a piece of their technology, they get excited and add some more to address the interested party’s desire. With their demo and impressive technological skills, they have gotten money from business plan competitions and investors, which I think is possibly the worst thing that could have happened to them.

Neither the “someone” watching their demo at a conference nor the business plan judges nor the investors are paying customers. What the team calls an “MVP” is simply a sexy proof of concept. They say they are testing hypotheses, but the hypotheses they are testing relate to technological feasibility. They claim they are “pivoting” – which means they have run out of business ideas but not money – on a regular basis. And as a result, they’re not making progress.

Why are they devoting all their time and money to building when, as a startup, they have precious few resources? Because they built it themselves, and they love it, and they’ll be darned if you tell them their MVP isn’t attracting any paying customers and that they should instead focus on an honest dialogue about customer needs. They are too beholden to the IKEA effect. They claim to be in inquiry mode but really are much more in advocacy mode for what they have developed.

Compare this to another recent alumni team, FINsix. The company won recognition and a slew of awards last month at CES for its product, a miniature laptop power adapter that is a quarter the size of today’s power bricks.

But when they first showed up in my class, they only had a promising technology from the labs. I’m sure that power supply geeks will be impressed by Very High Frequency (VHF) switching that is 1000x faster and with a 10x reduction in converter size. “The elimination of heavy components, like magnetic core transformers, enables superior resistance to mechanical shock and vibration,” according to their website, which sounds like a good thing, too.

However, none of that helps a well-defined group of customers address a pain that they’re willing to pay money to address. FINsix recognized that, and so rather than build, build, build, they took some time to learn about customer needs.

“We were able to test the [VHF switching] concept with many different markets using an electronic brochure and extensive surveying to determine our beachhead market of laptop power suppliers,” co-founder and CEO Vanessa Green told me. A brochure.

There is a lot less emotional investment in an electronic brochure than an MVP that the engineers build. And their analysis allowed them to consider a range of markets, from cell phones to LED lighting, before determining that laptop power adapters were the best way to gain a core group of paying customers that would sustain the company so that it can develop more products.

You can’t develop the right product for your customer if you fall in love with a prototype that nobody wants to buy.

Had they fallen in love with their technology, or the first prototype they built, they may never have gotten to the point of selling a consumer laptop charger. Think that app makers are immune to the dangers of an MVP? Sure, an app has less initial investment required, but otherwise, a business is a business. It’s easier to spin the roulette wheel when you don’t need as much upfront or sustaining capital, but that doesn’t mean you have a solid startup.

You can’t build great products in the dark, without a well-defined customer. And you can’t develop the right product for your customer if you fall in love with a prototype that nobody wants to buy.

So unless your end game is hoping that before the money runs out a competitor will buy you for your engineers or technology, you need to stop obsessively building, and start an honest dialogue with potential customers about their needs. It may not be as fun as tinkering with a “product,” but it is far less stressful than playing the acquisition lottery. That is what we call “disciplined entrepreneurship” where you can have both great technology and great marketing, leading to epic products. It is a false dichotomy to think you can only have great technology or great marketing, as some commenters have recently claimed in a myopic comparison of Stanford and MIT graduates.

Think I’m a conservative East Coast entrepreneurship instructor who’s behind the times? Last week when I was in San Francisco and chatted with David Bergeron of T3 Advisors and Cory Sistrunk and Ed Hall of Rapt Studio, they were right on the same page. “The MVP mentality has unintentionally taken us away from ‘user-centered design’ and a focus on the customer,” they told me. “We have to focus on the WHYbefore we can focus on the HOW and WHAT.”

For the entrepreneur, stop obsessing about your MVP. Your first question, before HOW and WHAT, has to be “FOR WHOM?”

The author

Bill Aulet

A longtime successful entrepreneur, Bill is the Managing Director of the Martin Trust Center for MIT Entrepreneurship and Professor of the Practice at the MIT Sloan School of Management. He is changing the way entrepreneurship is understood, taught, and practiced around the world.

The Disciplined Entrepreneurship Toolbox

Stay ahead by using the 24 steps together with your team, mentors, and investors.

The books

This methodology with 24 steps and 15 tactics was created at MIT to help you translate your technology or idea into innovative new products. The books were designed for first-time and repeat entrepreneurs so that they can build great ventures.

Entrepreneurship Can Be Taught, Writer Says

Republished from The Boston Globe. An interview written by Michael B. Farrell

Demand for such education is ‘off the charts,’ says MIT author of a how-to book

Q. Why are more people pursuing entrepreneurship?

A. When you look at the other options, they really aren’t very appetizing. People are disenchanted with working on Wall Street. Working at a large company and getting a job for life — that option doesn’t exist anymore. People like Jeff Bezos of Amazon.com are the new rock stars of this generation. People like him are the ones changing the world.

Q. What’s the biggest mistake people make when starting out?

A. People tend to focus on what they want instead of what the customer wants. They start building a company and try to push stuff out instead of determining who the customer is and building the company for them.

Q. You argue entrepreneurship isn’t innate. So, can anyone learn how to run a successful business by reading your book?

A. Entrepreneurship can be taught. Is it being taught like math in a classroom? No. It has to be taught in a different way. The overall need the book is fulfilling is that overall demand for entrepreneurship education is off the charts. It used be close to zero. When I went to college there were no classes in entrepreneurship. It is hard to teach entrepreneurship, but we do it all the time. It doesn’t mean you’re guaranteed success. But entrepreneurship needs to be thought of like a discipline.

Q. So, is the book a way of bringing entrepreneurship education to the many people who aren’t able to study it at places like MIT?

A. Is it about helping what’s going on here in Kendall Square? Yes. It will help entrepreneurs in Kendall Square. But only a few thousand people can be added to MIT each year. The question is what do they do in places like Lawrence, where you’ve got a lot of young people looking for jobs. You can be like Sal Lupoli from Sal’s Pizza, whose business is growing because he understands how to be a successful entrepreneur. We are trying to take what people can get at MIT and bring it to the rest of the world.

Q. Your book has an illustration of the 24 steps to a successful start-up and there’s a pot of gold at the end. Isn’t that misleading since most start-ups fail?

A. People believe the failure rate in start-ups is something like 90 percent. That is not true at MIT. You’re going to experience failure throughout the process, but most people are going to succeed and keep marching on. We have to have people who are ambitious and reaching for these big goals. The gold doesn’t just mean money.

Q. Is failure in business something that should be celebrated more?

A. We have to accept that if we want innovation-driven entrepreneurship, failure is part of the process. We celebrate wisdom that comes from failure, but not just to say that it’s OK to fail. You’ve got to try to win. It’s got to hurt when you lose. But you can’t be afraid of it.

Q. For people who aren’t getting the sort of mentorship you provide at MIT, where can they go for help?

A. There are a lot of organizations rising up. There’s Techstars and Y Combinator that are teaching people how to do this. Those are for-profit. But the question is, are they just skimming from the top and preparing start-ups to get funded and claiming success? You can also go to the Small Business Administration, and some chambers of commerce are running programs, too.

Q. But at some point, are too many people pursuing start-ups? IBM and Google still need employees.

A. Everyone can’t be an entrepreneur. If you are going to have 50 percent of the people become entrepreneurs, who is going to work for them? There’s a saturation point, but we’re nowhere near it.

The author

Bill Aulet

A longtime successful entrepreneur, Bill is the Managing Director of the Martin Trust Center for MIT Entrepreneurship and Professor of the Practice at the MIT Sloan School of Management. He is changing the way entrepreneurship is understood, taught, and practiced around the world.

The Disciplined Entrepreneurship Toolbox

Stay ahead by using the 24 steps together with your team, mentors, and investors.

The books

This methodology with 24 steps and 15 tactics was created at MIT to help you translate your technology or idea into innovative new products. The books were designed for first-time and repeat entrepreneurs so that they can build great ventures.

A Tale of Two Entrepreneurs: Understanding Differences in the Types of Entrepreneurship in the Economy

Republished from Ewing Marion Kauffman Foundation.

Not all startup companies are created equal. Although both innovation-driven enterprises (IDEs) and traditional small- and medium-sized enterprises (SMEs) can provide valuable products and services and create jobs, IDEs – startups focused on addressing global markets based on technological, process or business model innovation – can potentially create hundreds or even thousands of high-skill jobs if they succeed.

The distinctive differences between these two forms of entrepreneurial ventures – and their importance for governments and policymakers wanting to support long-term economic growth – is the subject of a new paper released today by the Kauffman Foundation. “A Tale of Two Entrepreneurs: Understanding Differences in the Types of Entrepreneurship in the Economy,” examines IDEs and SMEs, their roles in local, regional and global economies, and their differing needs in terms of financial and policy support.

While traditional SMEs don’t require an innovative product, process or business model to succeed, IDEs are based on building competitive advantage through innovation on one or more of these dimensions.

For this reason, IDEs are more likely to be founded by teams of individuals with diverse skills and often higher levels of education than SME founders. SMEs focus on local or regional markets and create “non-tradable” jobs, whereas IDEs consciously pursue global markets and create jobs that can be performed in different locations. Funding sources also differ: SMEs tend to be individual or family owned with little outside investment, while IDEs have a diverse ownership base with external investors.

Because of their global aspirations and the criticality of both capital investment and competitive advantage, IDE entrepreneurs face much greater risk than SMEs – but the payoff can be much greater. Unlike SMEs, which typically grow in a linear fashion, IDEs tend to start out losing money but achieve exponential growth if successful. Government policies and programs, however, tend to favor SMEs, which often produce faster, more visible results – an approach that may undermine the success of potential new IDEs. [more…]

The author

Bill Aulet

A longtime successful entrepreneur, Bill is the Managing Director of the Martin Trust Center for MIT Entrepreneurship and Professor of the Practice at the MIT Sloan School of Management. He is changing the way entrepreneurship is understood, taught, and practiced around the world.

The Disciplined Entrepreneurship Toolbox

Stay ahead by using the 24 steps together with your team, mentors, and investors.

The books

This methodology with 24 steps and 15 tactics was created at MIT to help you translate your technology or idea into innovative new products. The books were designed for first-time and repeat entrepreneurs so that they can build great ventures.

U.S. Immigration Policy Is Killing Entrepreneurship. Here's What to Do About It

Republished from Forbes. Co-written with Matt Marx.

When we teach our introductory entrepreneurship class at MIT, we take it for granted that each of our 75 students will be able to start an American company upon graduating. But many of them lack one thing they need to be able to do so—permission from the United States government to continue working in our country.

In this academic year, three in 10 MIT students, including four in 10 graduate students, are not U.S. citizens or permanent residents. So for them our entrepreneurship class is likely to remain just an academic exercise. Their student visas expire when they graduate, leaving them with two options, to leave the country or find an existing company to sponsor them for a chance at an H-1B visa.

Either way, they can’t start a company in the United States. Their only hope is to secure a visa extension for “optional practical training,” after which they must apply for an H-1B visa for their startup once it grows large enough to be recognized as a legitimate enterprise—among other things, one that employs 25 or more employees. But even if they follow this path, they are not allowed to become a majority shareholder in their own startup.

Much discussion about immigration views it as a zero-sum game, where a set number of jobs at existing companies will be awarded either to Americans or to foreigners. Indeed, the logic underlying the H-1B process is that a visa should be granted only when a qualified American cannot be secured for a position. The present view of immigration policy, where the resulting labor supply is applied only toward jobs at existing companies, misses the essential contribution that would-be immigrant entrepreneurs sitting in our classroom can provide, the creation of new American companies, and with them new American jobs.

Innovation-driven entrepreneurs are the engine of a vibrant economy. Their high levels of education and their pursuit of global markets and rapid expansion create jobs and economic prosperity. And many of them, such as these MIT students, were not born in the United States. There is a global competition to recruit this talent, and countries such as Canada, Singapore, and Australia have introduced policies that are far more welcoming than ours. Although strides have been made in retaining immigrant science, technology, engineering, and mathematics students, these measures are largely designed to let immigrants to fill jobs in existing companies. Would-be immigrant entrepreneurs still face major obstacles and uncertainty.

However, a window of opportunity around immigration may be opening. Alejandro Mayorkas, director of the United States Citizenship and Immigration Services, recently addressed a group of MIT students and acknowledged the benefits of keeping talented foreign-born entrepreneurs in our country. He is working to streamline USCIS procedures to aid entrepreneurs as much as possible under existing laws and has just launched a website, www.uscis.gov/portal/site/uscis/eir, to help entrepreneurs understand their options. Meanwhile President Obama and a number of congressional Democrats and Republicans alike have publicly expressed a desire to help foreign-born entrepreneurs stay in the United States.

Certainly we don’t pretend to have all the answers, and we are mindful of moral (and political) hazard. But we see three areas that the U.S. government should revisit in order to address the needs of foreign-born entrepreneurs’ desire to start American companies and create American jobs.

First, immigration policy needs to focus not just on skilled immigrants filling positions in existing companies, but on immigrants’ potential to create new companies, leading to the creation of new jobs. Perhaps a new EB-1 (priority worker) category could be created for entrepreneurs, similar to the existing category for scientists. The United Kingdom has designed a new entrepreneur’s visa for just such a purpose.

Second, we need to appreciate the talent of these entrepreneurs rather than making them feel like aliens. We have heard more than one outstanding foreign-born student reveal feelings of being treated like a suspect at a crime scene rather than a highly valuable asset. Other countries are increasingly becoming more welcoming to them, so our customer service policy has got to become more sensitive.

Third, one of the great advantages of startups is that they typically move fast and run lean and mean. They eschew bureaucracy in favor of action and experimentation, which is what makes them so great. We are in a competitive market and must actively recruit this talent and be more responsive to its needs.

We hope that our talented, foreign-born students at MIT and other higher learning institutes aren’t shown the door at the conclusion of their American education. Let’s instead use immigration as a tool to promote innovation-driven entrepreneurship and the gains in jobs and economic prosperity that result.

Or to put it another way, what if Steve Wozniak had been born not in San Jose but in Saskatchewan?

The author

Bill Aulet

A longtime successful entrepreneur, Bill is the Managing Director of the Martin Trust Center for MIT Entrepreneurship and Professor of the Practice at the MIT Sloan School of Management. He is changing the way entrepreneurship is understood, taught, and practiced around the world.

The Disciplined Entrepreneurship Toolbox

Stay ahead by using the 24 steps together with your team, mentors, and investors.

The books

This methodology with 24 steps and 15 tactics was created at MIT to help you translate your technology or idea into innovative new products. The books were designed for first-time and repeat entrepreneurs so that they can build great ventures.

The Next Big Thing in Energy Innovation and Investing? Let’s Talk Water

Republished from Xconomy.

Energy innovation and investing are exploding right now. Technological breakthroughs are seen as perhaps the greatest hope to solving our dire energy challenge. However, what is often overlooked is the link between finding or creating new sources of energy and the effects on food and water.

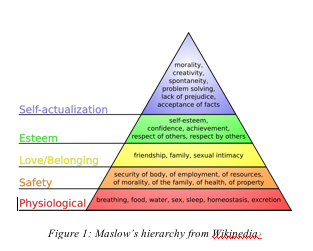

Indeed, if you think of energy as a coin, the flip side is water and food. The scary thing is that food and water are both lower on Maslow’s hierarchy of human needs—i.e., they are more fundamental to human survival. Yet, the current rush to create new sources of energy—including “clean” energy—may have potentially disastrous tradeoffs on our food and water supplies. Going forward, trading off energy creation for water—meaning creating new sources of energy that depend on heavy use of water, as many do—will be less and less acceptable. That’s why the most exciting opportunities in energy entrepreneurship and investment lie in strategies that create more water or energy without adversely affecting the other.

The Linkage of Energy and Water

At a fundamental level, we can think of the greatest and greenest energy producer in the world—the leaf—and observe through the process of photosynthesis that energy, water, and food are an interrelated system. But let’s also look at some other examples:

- Biomass—This is the most obvious source of tension between food, water, and energy today. Corn as a feedstock for ethanol has been a contributor to the dramatic rise in prices of this commodity and hence food (although the exact amount of its effect can be debated). The development of cellulosic ethanol will go a long way toward alleviating this tension by eliminating the dependence on corn or other foodstuffs for ethanol production. But there are also other, more subtle elements to the equation that add new sources of tension. Ethanol production from plants requires substantial amounts of water—and it must be clean, fresh water, which is the most precious kind. Biomass has been the poster child for the tension between alternative energy and water/food but it is far from alone.

- Nuclear—Traditionally, nuclear power plants have been built near large sources of water to promote cost-effective cooling.

- Enhanced Oil Recovery—After initial production starts to slow down, oil wells traditionally have been flooded with water to boost pressure and improve oil recovery. This made excellent economic sense in the past, and will be even more economically attractive with the new price levels for oil.

- New Heavy Oil Recovery—Heavy oil is viscous, harder to recover, and less economically attractive than the normal light sweet crude oil that is the standard today because of its costs of extraction and refinement. Driven by attractive new price levels and national security concerns, Canada is developing a large amount of this huge potential energy source in what is known as the “Tar Sands.” The increasingly preferred method to extract heavy oil a process called SAGD (steam assisted gravity drainage), which uses prodigious amounts of water.

These are only a few examples, but they illustrate the tight relationship between energy, food, and, especially, water today—a relationship that often forces painful tradeoffs when we try to produce more energy. But there are no laws of nature I am aware of that make this tradeoff necessary in perpetuity.

The Next Wave for Energy Innovation and the Future Focus for Productive Long-Term Energy Investing

I am often asked by investors and entrepreneurs, “What do you like with regard to the energy space?” My answer is twofold:

I am often asked by investors and entrepreneurs, “What do you like with regard to the energy space?” My answer is twofold:

1. Water and,

2. Any company that decouples energy and food/water. The company should produce or save energy without adversely affecting the water and/or food supply.

Water has been overlooked as an area for entrepreneurship and investment for good reason: it is a very challenging arena. Water is similar to energy in its diversity and the magnitude of challenges it presents (see What’s Wrong with Energy Investing Part II)—and it has even more conservative ultimate users and buyers. Nonetheless, water’s time in the limelight has come, and many companies built around clean water technology that couldn’t get a second look a year ago now are drawing tremendous interest. Often these companies have been around for over a decade because that is how long it has taken such ventures in the past to get traction. In addition, new companies like NanoPur, a venture involving the use of novel carbon nanotube technology to improve the energy efficiency and cost effectiveness of desalination (and a finalist for the recent MIT Clean Energy Entrepreneurship Prize backed by NSTAR and the U.S. Department of Energy), are springing up with much higher frequency. The new economics of water make companies that increase the supply of clean water a compelling value proposition that will only increase over time. While there may be alternative energy sources and fuels, there really is no substitute for clean water.

The second point I raised above is really a necessary condition for building sustainable energy companies in the future. Only a year or so ago, venture capitalists routinely asked each new potential investment company about its India and China strategies. Similarly, for energy companies, the question will be, “What effect will the venture have on food and water?” Those companies that can decouple the tradeoffs between the two will be interesting, and those that do not, will not be attractive investments. Even existing, well-managed energy companies are now closely examining this issue, which will only increase in importance. An example of a potentially exciting new company in this regard is another finalist from the aforementioned MIT Energy Prize competition: Sequesco. This team of three PhDs plans to develop genetically modified non-photosynthetic bacteria (an approach different than photosynthesis-based algae production) to more efficiently convert harmful CO2 into biomass fuel. This is a double play (i.e., it decreases CO2 emissions and increases energy supplies) without negative ramifications on water or food—at least that we know of yet.

In summary, trading off water for energy is a devastatingly bad idea, for as wise old Benjamin Franklin said, “When the well is dry, we learn the value of water.” In the first stage of energy innovation, we began to deplete the well. But in the second stage, beginning now, we must move on from this folly and find more intelligent solutions.

The author

Bill Aulet

A longtime successful entrepreneur, Bill is the Managing Director of the Martin Trust Center for MIT Entrepreneurship and Professor of the Practice at the MIT Sloan School of Management. He is changing the way entrepreneurship is understood, taught, and practiced around the world.

The Disciplined Entrepreneurship Toolbox

Stay ahead by using the 24 steps together with your team, mentors, and investors.

The books

This methodology with 24 steps and 15 tactics was created at MIT to help you translate your technology or idea into innovative new products. The books were designed for first-time and repeat entrepreneurs so that they can build great ventures.